Following our recent blog article announcing the FDA approval of Novo Nordisk’s Wegovy® tablet and its introduction to the U.S. market, initial pricing from the manufacturer for the commercial market (i.e., employer sponsored plans) is consistent with the existing injectable formulation.

Recent published media articles are stating the cost for the Wegovy oral tablet, depending on the dosage, range from approximately $149–$299 per month. These prices are based solely on those without insurance, otherwise referred to as self-pay cash paying customers. These prices are significantly lower than what the manufacturer charges to the commercial market.

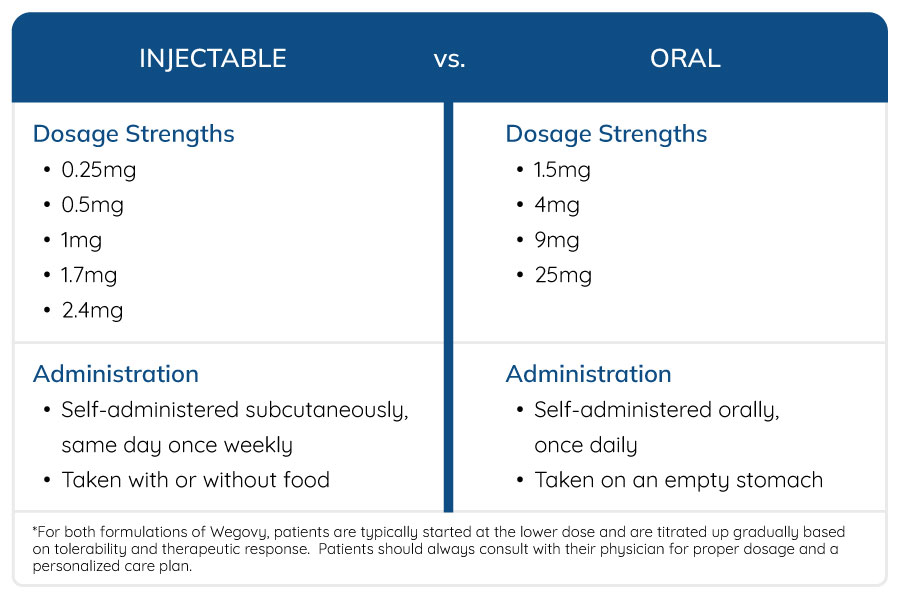

Dosage and Administration

How will the Release of the Oral Tablet Impact Plan Sponsors?

Despite the introduction of oral Wegovy, injectable GLP-1 therapies are expected to remain a core treatment option. Although the pricing for injectable Wegovy is not expected to change at this time, the entire GLP-1 market will evolve as competition intensifies, particularly with the anticipated launch of Eli Lilly’s oral GLP-1 candidate, orforglipron, and additional oral entrants that may influence future pricing strategies.

With the marketplace now offering an oral alternative, overall GLP-1 utilization and access is expected to increase significantly and add to further cost pressures on plan sponsors. Benecard continues to develop a comprehensive GLP-1 strategy for its plan sponsors, adapting to the evolving GLP-1 marketplace. Understanding thoughtful and innovative benefit design, ongoing clinical oversight, and careful formulary alignment will be essential to ensure appropriate access, effective utilization, and sustainable outcomes for plan sponsors.

Please contact your Benecard Client Relations Manager or Sales representative to learn about Benecard’s comprehensive GLP-1 strategy.

Sources:

Novo Nordisk’s Wegovy Pill Becomes First Oral GLP-1 Available in U.S. | PharmExec

https://www.wegovy.com/taking-wegovy/dosing-schedule.html?utm_

FDA Approval of Novo Nordisk’s Oral GLP-1 Marks a New Phase in Obesity Treatment – Benecard

Primary care copays could triple (from $10 to $30).

Primary care copays could triple (from $10 to $30).